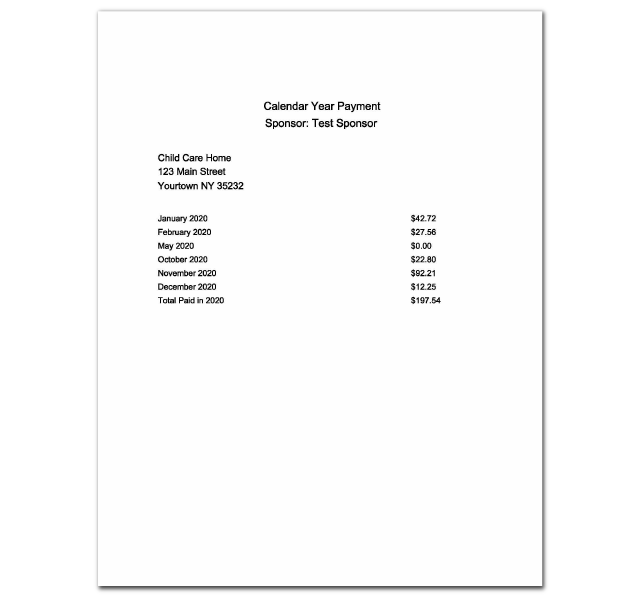

Reimbursements by Calendar Year (Sponsor-Level)

The IRS considers income from the CACFP as taxable. This report will tell you how much money you have received in CACFP reimbursements over the calendar year so that you can file accurate taxes. CACFP reimbursements should be included on IRS Form 1040 Schedule C in Part I.

NOTE: the CACFP works on a reimbursement basis. This means that the payments made during a calendar year do not line up with the meals served that year. For example, meals served in December are paid in January.

To run this report:

- Login at the sponsor level

- Click on the green tab for "Reports"

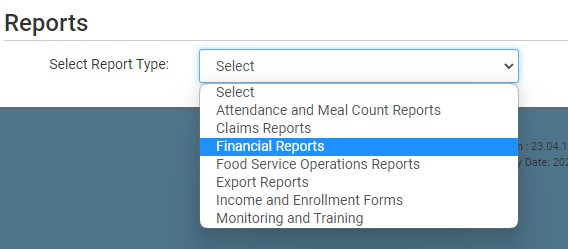

- From the dropdown menu of report categories, select Financial Reports.

- Select the calendar year

- Click the green Run Report button to generate a download link

- Click “Download Report” and your web browser will download the file into the folder you designate.