Reimbursements by Calendar Year (Site-Level Version)

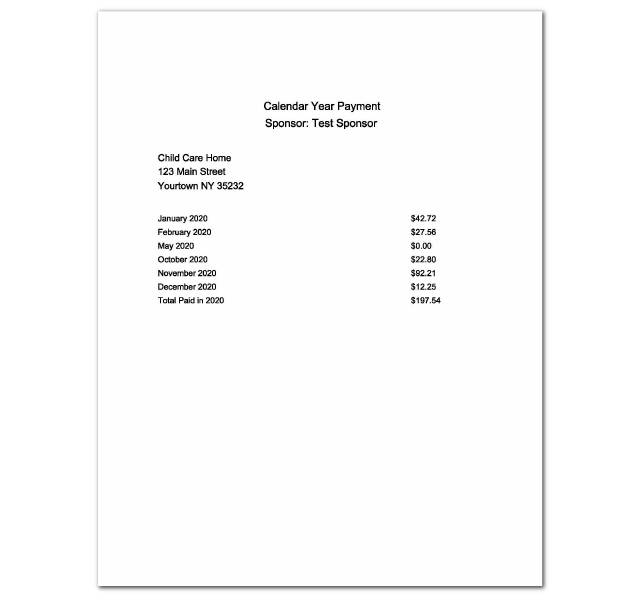

The IRS considers income from the CACFP as taxable. This report will tell you how much money you have received in CACFP reimbursements over the calendar year so that you can file accurate taxes. CACFP reimbursements should be included on IRS Form 1040 Schedule C in Part I.

NOTE: the CACFP works on a reimbursement basis. This means that the payments made during a calendar year do not line up with the meals served that year. For example, meals served in December are paid in January.

To run this report:Click on Reports from the main site dashboard

- From the report selection screen, choose the category Financial Reports

- Click on the hyperlink for the report titled Reimbursements by Calendar Year. This will take you to the screen to make your selections for the report.

- Select the calendar year for the report

- Click the green Run Report button to generate a download link.

- Click the hyperlink to Download Report in PDF format.