Standard Meal Allowance (Site-Level Version)

Family child care providers can deduct all of the costs of providing food to the children in their care on their taxes on IRS Form 1040 Schedule C in Part V. Meals and snacks that were served but not reimbursed by the CACFP can be included in the deduction.

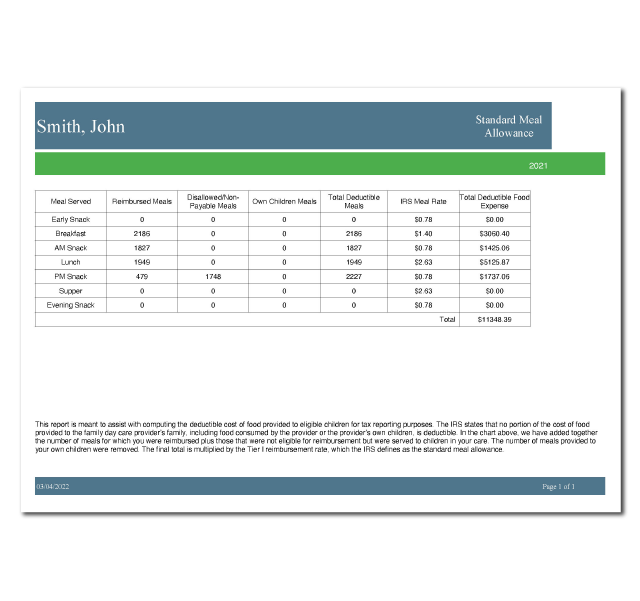

This report uses the standard meal allowance method, which is a way to calculate the deduction that does not involve saving food receipts. The Standard Meal Allowance Method adds up all the breakfasts, lunches, suppers, and snacks that you served to the children in your care, takes away any meals served to your own children, and multiplies the totals by the Tier I rate.

The alternative to the standard meal allowance is to track all food receipts, which you can do using our Expenses feature.

To run the report:

- Click on Reports from the main site dashboard

- From the report selection screen, choose the category Financial Reports

- Click on the hyperlink for the report titled Standard Meal Allowance. This will take you to the screen to make your selections for the report.

- Select the calendar year for the report

- Click the green Run Report button to generate a download link.

- Click the hyperlink to Download Report in PDF format.